Tips to Get the Best Payday Loans

When it comes to getting the best payday loans, there are certain things that you need to know. You need to make sure that you shop around, you need to keep your credit score in mind, and you need to avoid scams. These are some of the best tips to get the best payday loans.

Avoid scammers

Payday loans are an easy way to get money if needed, but they can also be dangerous to your finances. If you need to borrow money, ensure you are not getting a loan from a shady company.

The best way to protect yourself is to check out the lenders’ websites. Make sure they have a secure website. A secure site will have a lock icon next to the URL.

When you apply for a loan, the lender may ask you to provide personal information such as your address, phone number, or credit card. They may also want you to give them a prepaid debit card or gift card for payment.

Some lenders will pressure you to sign an agreement and pay an upfront fee. Another red flag is if they want you to send them money through a wire transfer or overnight service.

You can protect yourself by checking that the lender is licensed to operate in your state. You can also contact the attorney general of your state to report scams.

Scammers often try to trick people into taking out loans they do not need. For instance, a scammer might tell you you are ineligible for a loan because you owe money to another company. In reality, it is not legal for a payday lender to demand repayment of money you owe to another company.

Typically, these payday loan scams use the internet for advertising their services. They then call people who have applied for a loan online. Those desperate for cash will be likelier to give out their personal information to strangers.

Find a lender with a higher maximum amount.

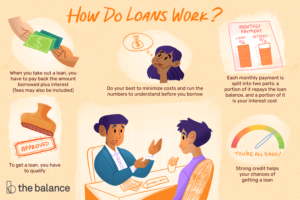

If you’re in the market for a loan, you may want to find a lender with a higher maximum amount. A payday loan is a short-term loan, typically due in two to four weeks. However, you should be aware that these loans can be expensive and lead to a debt cycle. Fortunately, there are ways to avoid this problem. Before you apply for a loan, make sure you understand the risks, and you can start building a good credit history.

One way to avoid a financial crisis is to look for lenders who report to the major credit bureaus. This is because lenders who are not reputable can lead to more fees and penalties. When searching for a lender, you should look for a direct lender instead of an unlicensed loan shark.

Another thing to consider is the APR or annual percentage rate. This figure reflects the interest, fees, and length of the loan. For example, a $500 loan with an APR of 200% will cost you six months to repay it.

You should also be mindful of late fees and returned check fees. These charges can add up and may even be higher than the initial amount you borrowed. As a rule, you should always shop around to find the best deal.

Finally, be aware of the laws in your state. Check with your local Judge Advocate General’s office to determine the restrictions. Lenders must make clear the APR and other loan terms before they sign the loan agreement.

Once you’ve found the right lender, be sure to read through the terms and conditions carefully. Make a budget and consider how long you can afford to repay the loan.

Consider your credit score.

When considering payday loans, your credit score is one of the most important factors. A higher score means you have more chances of getting approved for a loan and are more likely to get lower interest rates.

You’ll first need to check your credit report to find out what’s on it. There’s a wide range of information on a credit report, but there are some things you can look out for that will help you interpret the information.

Generally, most lenders rely on one of two credit scoring models: FICO or VantageScore. A higher score increases your chances of getting approved for a loan, but you should still compare offers before you apply. Some companies even offer online pre-qualification, which is a great way to know how much you can borrow before you fill out an application.

Some payday loan providers can confuse you with confusing interest rates and fixed charges, so it’s important to read the fine print and understand what you’re getting into. Another thing to consider is how long the loan is for. If you don’t plan to pay the money back soon, you should look for a lender that doesn’t charge late fees or prepayment penalties.

Lastly, you’ll need to provide proof of your income. This can include bank statements, pay stubs, and tax returns. Your lender will look at your debt-to-income ratio to determine how much you’ll have to pay monthly to repay the loan. Getting your finances in order is the best way to get a better loan.

Payday loans can be a lifesaver when you need extra cash to cover an emergency, but if you’re looking for a loan, shopping around for the best options is always a good idea.