Simple Methods To Help You Manage Credit Cards Wisely

Managing credit cards wisely starts with choosing the best credit card for your needs. Different cards come with additional fees and terms, so it is important to compare them before applying. Moreover, interest rates and other expenses can vary from one card to another. Choosing a card with the best terms and lowest interest rate is critical in keeping your credit score intact. To make your budget more realistic, compare the terms and conditions of each card and make the most informed decision.

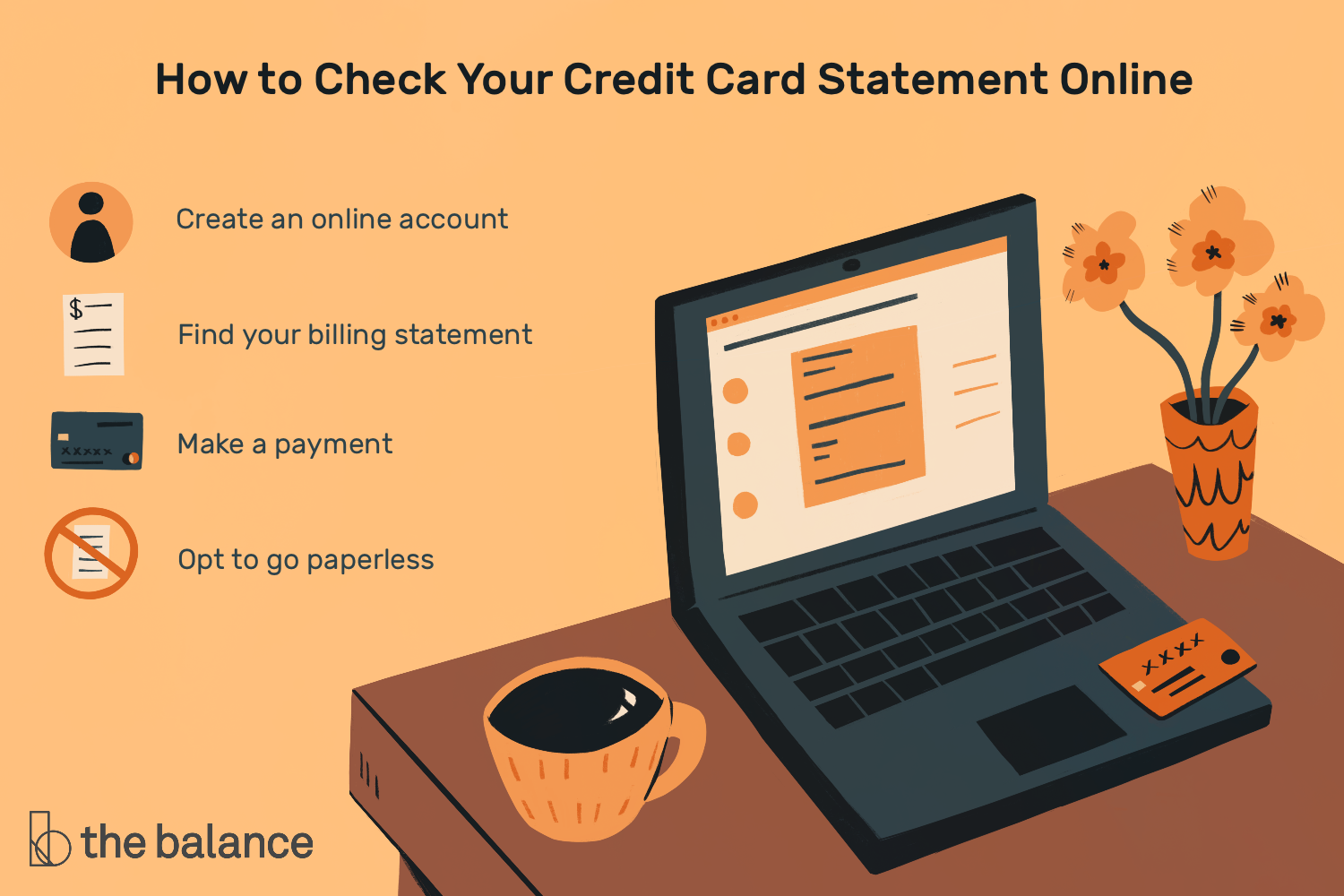

The best time to monitor your credit card balance is regularly. Many people forget that their daily purchases can add up, so checking your account balance is crucial. It is a good idea to download a credit union mobile app and put it on your phone’s home screen. This will remind you to check your account balance regularly. Also, consider setting up a weekly notification so that you don’t forget to pay.

Managing your credit card debt is essential for your financial health. Paying off your balance each month is one of the easiest ways to improve your credit score and avoid interest charges. However, it is crucial to keep an eye on your balance to prevent overspending regularly. If you can’t afford to pay your monthly bills, you can always set up automatic payments on your credit card and use your money for other expenses.

Checking your credit card balance is an important step in keeping track of your finances. Even if you are responsible, you may forget that daily purchases add up to a large amount. To ensure you’re not going over your credit limit, download a credit union app and put it on your phone’s home screen. This way, you’ll have a constant reminder to keep an eye on your balance. If you can’t remember to check it every day, set up a weekly notification on your phone.

Using your credit card wisely can help you maintain a healthy credit score. If you use your card responsibly, you can use it to track your monthly expenses and keep track of your cash flow. To avoid the risks of overspending, it is advisable to make monthly payments in full. This will ensure that you don’t overspend, and to stay on budget, you’ll have enough funds.

Responsible credit card usage will boost your credit score. You can earn rewards, build credit history and track your cash flow by smartly using your cards. In addition to your financial interests, the card company will gain a small amount every time you use your card. Increasing your credit limit can also help lower your credit score. And this is the best way to manage your credit. It will also help you to maintain a healthy financial situation.

Managing credit cards responsibly will benefit both you and your credit union. It will also help you build your credit score and earn rewards by using your card wisely. By monitoring your accounts regularly, you will keep them under control and avoid getting into debt. The same goes for your finances. If you can afford it, you will pay it back. If you don’t have a steady income, you should consider applying for a loan and use cash to pay off your credit card balance.

Checking your credit score is important for all cardholders. The best way to do this is to ensure your credit card is in balance and don’t spend more than you have available. You should also check your balance regularly, as you may be tempted to spend more than you can afford. Using a card responsibly will help your credit score and save you from debt. If you’re worried about your credit score, try these simple methods to manage your cards.