A Great Guide On How To Find Cheap Auto Insurance

If you want to find cheap auto insurance, it’s essential to shop around before choosing one company. There are many ways to save money on auto insurance, including bundling your coverage with another. It can save you money on the collision and comprehensive portion, but it’s also important to compare prices before choosing a company. You can also lower your premium by increasing your deductible on the collision and comprehensive portions of your policy. According to Nationwide, you can save anywhere from 15 to 30 percent by increasing your deductible.

Progressive

Buying car insurance is necessary, but it doesn’t have to be costly. By following a few tips, you can save money on your policy. For starters, gather quotes from several car insurance companies and compare them. Also, look for discounts. Most companies offer discounts to drivers who qualify for them.

Your car also has an impact on your insurance rates. Vehicles with lower repair costs are usually cheaper to insure. However, it would help if you remembered that buying a cheap car doesn’t mean it has low insurance rates. If you’re planning to get a more affordable car, compare rates by vehicle make and model. Also, avoid costly tickets and violations, such as running red lights and speeding. You can skip rental reimbursement coverage if you have a car you’ll rarely use. Lastly, if you’re married, you’ll find it cheaper to get insurance from your spouse.

Besides looking for discounts, you can also consider usage-based and per-use discounts. These are based on your driving habits and can be pretty helpful in securing a cheaper policy. Additionally, you should also take into account your car’s value. Vehicles that get good mileage will usually cost less to insure.

Lastly, it would help always to compare insurance companies customer service. Make sure that the companies you’re looking into have good customer service, as this will increase the chances that they’ll be more responsive to your needs.

Geico

Geico is a great place to find cheap auto insurance if you search for coverage online. You will find that the company offers a variety of options for your needs, and they provide some great features that will help you save money on your policy. For instance, you can use online features to check on your premiums. You must input your name and policy number to understand your coverage and rates.

You can also use the mobile app to make claims from your phone. The app also has chat services, and you can talk to a Geico agent in your local area to get help with a lawsuit. The website is also easy to use and allows you to get a quick car quote as well as details on discounts.

GEICO offers cheap auto insurance rates and excellent customer service. They also offer discounts for their members. If you have a vehicle over a few years old, you can consider taking out GAP insurance to cover the difference between the value of your car and the amount owed.

If you are a student, you can also save money with Geico. They have a student discount of 15 percent off your coverage costs if you have a B average or higher. But you must be between sixteen and twenty-four years old to qualify. In addition, Geico also offers discounts to people who have multiple policies with the company. Generally, multi-policy holders get discounts of up to twenty-four percent.

State Farm

Having a good insurance policy will protect your assets in the event of a car accident. You’ll want to ensure that your policy covers rental cars and travel expenses if your vehicle is in the shop. It can also cover hotel and transportation costs if you’re injured in an accident that leaves you stranded more than 50 miles away. While the limits of these benefits vary by state, they’re a great way to save money on auto insurance.

State Farm is one of the largest private passenger auto insurance companies in the country. They also offer a variety of other financial products, including life insurance and home and renters insurance. In addition to providing competitive rates, State Farm offers a seamless online experience. You can track your policy, pay your premium, and file claims all online. You can also manage your policy from your smartphone with the State Farm app, which has excellent reviews on Apple and Google Play.

Your driving car is one of the most important factors to consider when looking for cheap auto insurance. Sporty, luxury, and expensive cars tend to cost more to insure and repair. Furthermore, these vehicles are more likely to be stolen. Therefore, you should consider buying a cheaper car or taking a defensive driving course. Many insurers offer discounts for drivers who take a defensive driving course.

Smaller insurers

If you’re in the market for auto insurance, it’s always wise to shop around. Smaller insurers often offer better rates than big insurance companies. They can provide more individualized services and lower yearly premiums. You can find the right policy by comparing rates from multiple companies online. You can also work with a local car insurance agent.

Bundling your insurance policies may also save you money. You can save up to 29% if you have more than one auto policy with the same company. You can also receive discounts for bundling policies, such as collision and comprehensive coverage. Be sure to ask your insurer about bundle discounts.

You can also lower your car insurance rates by raising your deductible. This factor may not be evident to you, but it can significantly reduce your insurance costs. Deductibles are the amount of money you’ll pay out-of-pocket when you make a claim. Once you pay the deductible, the insurance company will pay for repairs.

Discounts for multiple vehicles

Discounts for multiple vehicles when buying auto insurance can be a great way to save money on your insurance. The best way to determine if you qualify is to contact several insurance companies and get quotes. Multi-car discounts are often available for married couples or people who live in the same house. However, some insurance companies will limit the number of vehicles you can insure on one policy.

While multi-car discounts are great, you should remember that they do not compound as you add more cars. A 10% discount for the first vehicle will not increase to a 20% discount if you add a second vehicle. But a different discount can be applied to each additional vehicle. Another way to take advantage of multi-car discounts is to stack uninsured/underinsured motorist coverage.

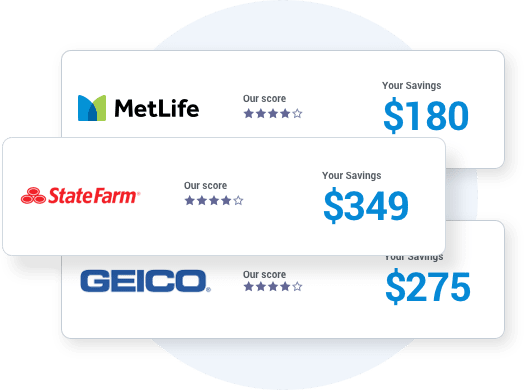

Most major insurance companies offer discounts for insuring multiple cars. These discounts can save you as much as 25% on your coverage for each vehicle. GEICO, State Farm, Progressive, and Nationwide all offer multi-car discounts. You can also check with your state’s Department of Insurance to see which companies offer multi-car discounts.

Multi-car insurance policies have other benefits, too. First, they are cheaper than a single policy. You can also add a second car and receive a 25% discount on both policies. Discounts for multiple vehicles vary by insurer, so check with your agent about specific values.

Dropping comprehensive and collision coverage

If you want to find cheap auto insurance, you might want to consider dropping collision and comprehensive coverage. This coverage will cover damages caused by accidents and other events. Combined, these two types of coverage are known as “full coverage.” Dropping these two types of coverage can reduce your overall premiums by up to 50%. Nonetheless, you may consider your financial situation and the likelihood of filing a claim before deciding to drop coverage.

Before deciding to drop comprehensive and collision coverage, you should evaluate the actual value of your vehicle. Since older cars are less valuable than new ones, you might be able to reduce the amount of coverage. It would help if you also considered your current savings level. If you save money each month, you can reduce the coverage you need or increase your deductible to reduce your insurance costs.

When shopping for car insurance, remember that insurers offer the same coverage at varying prices. This means that the best policy for your neighbor might not be the best option for you. Choosing the insurer that offers the lowest prices for a specific policy type is crucial. In addition to dropping comprehensive and collision coverage, consider lowering the liability limits on your policy. Lowering liability limits will reduce your overall costs, but they may not give you the protection you need in an accident.

You may wonder how much to drop collision and comprehensive coverage to find cheap auto insurance. Depending on the value of your car, collision and comprehensive coverage may be overpriced. However, if you can afford the repairs, you may want to consider getting the entire range.