Real Advice On Making Payday Loans Work For You

If you find yourself in a bind and need a short-term loan, there are a few alternatives that may help you get out of debt. Payday loans aren’t a good option if your credit is poor. While you may be tempted to take them out to make ends meet, they can get you trapped in a vicious cycle of debt and financial crisis. Here are some tips to help you get out of the payday loan trap.

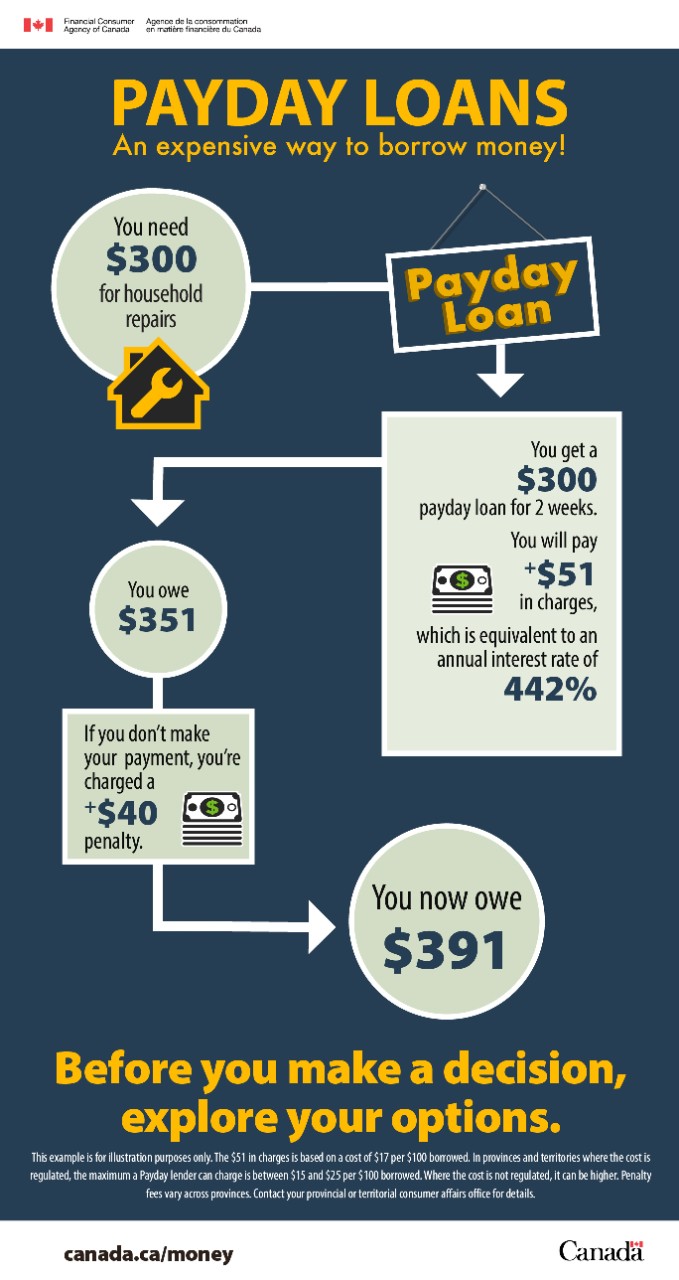

First, remember that payday loans are not a good idea. They are expensive, and they aren’t a good solution for everyday expenses. Many people use them as an emergency fund instead of saving for a rainy day. Even though they’re relatively short-term, they can still be a bad idea. If you take out a $500 loan, you’ll pay $75 in interest, or 15%. This isn’t ideal, especially for people with poor or no credit.

There are alternatives to payday loans. Community organizations provide free funds for important expenses. A database of payday loan alternatives is available online at NerdWallet. Besides cash advances from your bank, you can also take out pawnshop loans at lower interest rates. Building an emergency fund will also help you avoid taking out a payday loan. The best way to avoid payday loan debt is to build an emergency fund.

Another option is to take out a credit card or personal loan. While these options may be cheaper, payday loans can cause a cycle of debt. When you’re facing financial problems, you may want to use a high-interest credit-builder card to pay off your debts. Then you can use the money to consolidate your debts. While asking for help from family members is never fun, it is the best way to prevent deeper debt and strained relationships.

Before taking a payday loan, consider the consequences. If you’re unable to make your payments on time, you’ll end up paying more than you need to. If you’re living paycheck to paycheck, a payday loan will increase your chances of falling deeper into debt. You’ll have to be very careful not to let your savings disappear, as this will hurt your credit. If you need to borrow money, avoid payday loans and find a better alternative.

The most effective alternative to a payday loan is to build an emergency fund. This fund should be topped up regularly so you can avoid the need to borrow money again. Alternatively, you may choose to use your credit card as a cash advance. Then, you’ll have access to cash without worrying about repayments. But if you’re using a loan to cover expenses, you’ll need to have enough money to pay for it.

If you’re living paycheck to paycheck, you may find it difficult to repay your payday loan. When your next paycheck rolls around, you don’t have enough money to cover your essential expenses. In that case, you might need to take another payday loan. But this second one carries the same APR and fees. Once you get a second payday loan, it can be difficult to break this vicious cycle.

You can use your earned-wage advances to pay for your payday loans if you’re a high-income earner. If you’re not, then you should opt for direct-to-consumer payday lenders. But remember, a payday loan should only be used if you’re sure your next pay period will be larger than usual. It’s important to pay back the loan in full on time to avoid paying interest on the money you borrowed.

The key to making a payday loan work for you is to understand the repayment terms. A payday loan is a short-term loan with a fixed term and high costs. It can be not easy to repay, and you can end up in a debt-laden cycle. The best option is to use a personal finance program that teaches you how to manage your finances. You can also sign up for a free trial of the software and start using it immediately.