The Most Important Home Mortgage Information And Tips

If you are considering buying a new home, it is important to know the information and tips to help you get the best deal. There are many ways to get a mortgage, but you need to ensure you’re getting the best one for you.

Check your credit before applying for a mortgage.

If you want to buy a home, checking your credit before applying for a mortgage is important. Mortgage lenders use your score to determine if you can afford a home and what interest rate to charge.

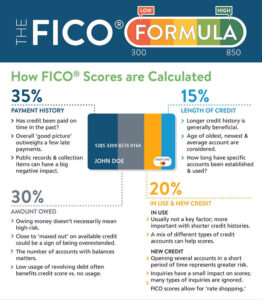

Your score is based on your payment history, the debt amount, and the mix of credit types. The higher your credit score, the lower your interest rate will be. It is also important to monitor your credit for errors.

Checking your credit before applying for a mortgage can help you avoid problems with your application. It can also help you increase your chances of getting approved.

Most mortgage lenders will check your credit before approving your loan. They will also pull your credit report from all three major bureaus to determine your credit history and credit score. They will often ask for a copy of your report before you get a mortgage.

You can get a free copy of your credit report once per year from each of the three bureaus. Depending on your current credit score, you may need to pull your report again if you have had a change in your credit in the past 120 days.

Before applying for a mortgage, you may want to consider getting pre-approved. Preapproval is a letter signed by a lender that lets you begin shopping for homes.

You can check your credit before applying for a mortgage online, through a financial institution, or by calling your bank. You may find that you have a low score. However, there are ways to fix the problem and increase your score.

A low score can make it hard to get a good interest rate on a mortgage. To help improve your score, you should start paying your bills on time. Also, avoid adding new debt.

If your score is too low, you may need to consider getting a credit card or refinancing your current mortgage. Applying for new credit can cause your score to drop. This is because your statistical risk of not repaying debt rises when you add new accounts.

Get pre-approved

Getting pre-approved for a home mortgage is an important step. This is because it is a way of letting a potential home seller know that you are a serious buyer. It will also give you an edge when making your offer.

However, getting pre-approved for a home mortgage is not quick and easy. There are many things to consider, and each lender has different requirements.

The best way to get pre-approved for a home mortgage is to shop around. Doing so will help you avoid surprises down the road. You should shop around for the best rates and fees.

During the pre-approval process, your credit report is checked. This will show your lender what type of debt you have, how much you spend, and your overall financial situation. Your lender will then assess your ability to make mortgage payments.

To get approved for a home mortgage, your credit score and down payment are two of the most important factors. In most cases, you’ll need a down payment of at least 5% of the total home price. A larger down payment can lead to a lower interest rate.

If you have any outstanding debt, this will delay your preapproval. You might also have to provide proof of identity and your employment history.

You should also have a clear idea of what your budget is. A solid budget will prevent you from spending more than you can afford. Once you have an estimate of what you can afford, you can shop for a mortgage that fits your budget.

Although it may seem like a small detail, your credit report is a key part of your pre-approval. Checking your credit report will not only show you how your financial picture is, but it will also help you determine your loan-to-income ratio. Ideally, your total debt payments should not be more than 36 percent of your gross income.

A hard inquiry will hurt your credit, but this is not a permanent condition. You can still improve your score by paying off some credit card debt.